The EZ-Link Wallet is a personal mobile wallet within the SimplyGo app that allows you to conveniently make payments online, in-store and overseas simply by tapping on a contactless payment terminal* or scanning a QR Code.

*Tap to pay via Google Pay is only available on NFC enabled Android phones.

EZ-Link Wallet with Mastercard is a virtual card within the SimplyGo app.

Once activated, you will be able to use your Mastercard on the EZ-Link Wallet (also known as Pay by Wallet) for contactless payments in-store, online and overseas at over 80 million Mastercard merchants.

Anyone with a valid NRIC or FIN will be eligible to apply for the EZ-Link Wallet with Mastercard. Singaporeans are required to perform the necessary identity checks via Singpass while FIN card holders are required to submit their Proof of Residence (with documents dated less than six months ago), in addition to their Myinfo details. Please note that the verification process for FIN holders may take up to five weeks.

There are no income requirements to enable the Mastercard on the EZ-Link Wallet (also known as Pay by Wallet).

We are required to verify your identity so that we can safeguard your funds. Your contact details are required for us to get in touch with you should there be any disputes with your transactions.

Applications for Singaporeans and PRs with a valid Singpass verification will be approved near real time if the information and documents submitted are in order. Approvals for FIN holders may take up to five weeks, FIN holders are advised to provide updated information in the application for an expeditious process.

You can find your application approval status via in-app updates.

For further assistance, please submit via our eFeedback form.

Everyone is only allowed to enable one Mastercard on the EZ-Link Wallet.

The EZ-Link Wallet implements security practices and policies adopted by the payment card industry to ensure prevention of theft of credit/debit card information. Furthermore, your authorization is always required before any payment is confirmed.

All EZ-Link Wallet with Mastercard users have the option to lock or unlock their virtual card within the app. Users can also hide sensitive card details (e.g. account number, expiry date, and CVC code) on their EZ-Link Wallet and take the additional precaution of using biometric authentication to access the SimplyGo app on their mobile device.

The EZ-Link Wallet with Mastercard is accepted by millions of Mastercard merchants worldwide – be it online, in-stores or overseas. Aside from Mastercard acceptance points, the EZ-Link Wallet can also be used as a payment method at participating SGQR merchants in Singapore.

- Tap to Pay and eCommerce – Simply look out for the Mastercard logo to tap to pay in-store or make payments online. NFC enabled Android users to also add the virtual Mastercard onto Google Pay to Tap to Pay for public transit rides via SimplyGo.

- Scan to Pay – For local usage, please look out for merchants displaying the SGQR sticker/standee with the EZ-Link app logo.

Tap to Pay (Mastercard)

Activate Mastercard on the SimplyGo app (also known as Pay by Wallet) to tap to pay* at Mastercard merchants worldwide. Simply tap with your mobile phone on the merchant’s contactless payment terminal to make payments in-store or tap on bus/train readers via Google Pay.

*Tap to pay via Google Pay is only available on NFC enabled Android phones.

Online Payments (Mastercard)

When making an online purchase with Mastercard accepted merchants:

- Launch the SimplyGo app and tap on EZ-Link Wallet

- Tap on “Virtual Card” to access the details of your virtual Mastercard.

- Copy the 16-digit card number, card expiry date and security code as requested by the payment platform.

- Once done, you may track the transaction on EZ-Link Wallet details page.

Scan to Pay (SGQR)

When making a purchase at a local merchant that accepts the EZ-Link Wallet with SGQR:

- Launch the SimplyGo app and tap on "Scan SGQR". Please ensure that the camera function is enabled for the SimplyGo app on your phone.

- Scan the SGQR code displayed at the merchant’s outlet.

- Enter the value of your purchase and authorize the payment with your payment pin, fingerprint or face ID.

- Wait for the ‘Payment Successful’ notification to appear to ensure that payment is successful.

Payment to and from other E-wallets and Prepaid Cards - The EZ-Link Wallet with Mastercard does not support the payment to and from other E-wallets.

Other Transactions - NETS prepaid card top up, Wilson Parking (Singapore) Pte. Ltd., Parking / SG Bill & Park@HDB are not accepted as well.

No activation is required for overseas transactions.

There are no additional fees involved for local transactions. You will only be charged for your purchase.

Please take note that there will be fees for cross-border transactions made online or in-store.

- Tap to Pay and eCommerce payments with your Mastercard on the EZ-Link Wallet (also known as Pay by Wallet). The following fees for cross-border transactions made online or in-stores applies:

Type of transactions

Fees involved

Foreign currency (FX) transaction fee

(Full cross-border charge, where original amount is not in SGD)1% fee levied by SimplyGo and 1% levied by Mastercard

Cross-border processing fee

(Amount is in SGD but transaction is settled outside of Singapore)1% levied by Mastercard

DCC

(Transaction in SGD made overseas)2% levied by SimplyGo and 1% levied by Mastercard

No, there is no limit to the number of transactions that you can make, as long as there is sufficient balance in your EZ-Link Wallet.

Yes, NFC enabled Android phone users to add the EZ-Link Wallet with Mastercard (also known as Pay by Wallet) feature to pay for transit fares using Google Pay.

Please note that $3 will be set aside for the settlement of transit transactions and customers are advised to keep a minimum balance of $20 for the ideal experience!

Top up your EZ-Link Wallet via the SimplyGo app.

The minimum top-up amount is $10. Choose your preferred bank card to be used as the source of funds for this top-up or add your bank card if you have not done so before. Tap on “Next” to proceed.

EZ-Link Wallet with Mastercard (also known as Pay by Wallet) is an extension of your EZ-Link Wallet and the funds are therefore linked to the EZ-Link Wallet. You can top up your EZ-Link Wallet with any debit or credit cards added onto your SimplyGo app.

Yes, top-ups of the EZ-Link Wallet are instantaneous. The new balance of your EZ-Link Wallet will be reflected immediately upon each successful top-up.

Yes, you can add or save more than one bank card for topping up your EZ-Link Wallet within the SimplyGo app.

The default card that you have selected will automatically be used for EZ-Link Wallet top-ups. If you wish to switch to another card, you can do so during the top-up process within the SimplyGo app.

The basic EZ-Link Wallet can hold a maximum of $500. Upon activating Mastercard on the EZ-Link Wallet (also known as Pay by Wallet), the maximum amount increases to $5,000. The amount in the EZ-Link Wallet cannot exceed S$5,000.

The annual top-up limit for the EZ-Link Wallet is $30,000, provided that no SimplyGo Concession cards which belong to you are added into the same account. Otherwise, the annual top up limit for the EZ-Link Wallet will be adjusted to $25,000. This is to comply with requirements set out in the Payment Services Act by the Monetary Authority of Singapore.

For questions with regards to the Payment Services Act, please click here.

Application for CIMB PayEasy is available via SimplyGo app only.

Below are the steps to apply for CIMB PayEasy:

- Activate EZ-Link Wallet on the SimplyGo app

- Tap on CIMB Pay Easy’s product banner

- Tap ‘Learn More & Sign Up’ to be routed to CIMB page to apply via Singpass

- Your application status will be shown, and you will be redirected to the SimplyGo app

No, SimplyGo does not share your personal data with CIMB. You will be routed to apply for CIMB PayEasy on CIMB’s platform using your Singpass.

No. Each user can only apply for one CIMB PayEasy account because the application requires Singpass verification.

Once your application is approved by CIMB, you will receive a confirmation from CIMB via SMS.

You will also receive a push notification from SimplyGo. You could find the confirmation message in the SimplyGo app inbox if you missed the PN.

Please enable notifications in the SimplyGo app settings to be promptly notified of your application status.

Yes, you can reapply by tapping the CIMB PayEasy’s product banner (i.e., same application process as before).

For any query, please contact CIMB.

On the Wallet top-up page, tap “Switch” and select CIMB PayEasy as your source of funds to top up the EZ-Link Wallet.

You can use CIMB PayEasy to top up the EZ-Link Wallet.

With the EZ-Link Wallet, payments can be made via SGQR at participating local merchants or using the EZ-Link Wallet with Mastercard allows you to make contactless payments at over 80 million merchants – both in-store and online.

Please refer to FAQ on EZ-Link Wallet on paying with the EZ-Link Wallet.

The maximum credit limit for CIMB PayEasy is S$500 per account.

Each top-up is in blocks of $100, up to a maximum $500 or your available credit limit.

The credit limit will be reinstated upon repayment.

No. You can only make top-ups to your EZ-Link Wallet with CIMB PayEasy.

Once the EZ-Link Wallet is topped up using CIMB PayEasy, the funds can then be used to top up your SimplyGo EZ-Link, EZ-Link, or SimplyGo Concession cards.

Please submit your enquiry on the affected top-up transaction via our eFeedback form. Please prepare a screenshot of the transaction on CIMB Clicks app as proof.

Steps for enquiry submission:

- Select “Unsuccessful Top-up of EZ-Link cards/charms/EZ-Link Wallet” under Category

- Select “CIMB PayEasy” under sub-category

- Select date and time of transaction

- Attach the screenshot, ensuring that your 16-digit account number is clearly visible

- Provide the top-up amount under the ‘Message’ section

Once we have verified the transaction error, we will credit the top-up amount to your EZ-Link Wallet.

Your selected top-up amount may be higher than your available credit limit.

Please choose an amount that is lower than your available credit limit.

While you cannot set CIMB PayEasy as the default payment method for your EZ-Link cards, you can use CIMB PayEasy as your payment method for topping up your EZ-Link Wallet. EZ-Link Wallet top-up via CIMB PayEasy will be prompted to users upon each EZ-Link wallet top-up.

Once the EZ-Link Wallet is topped up using CIMB PayEasy, the funds can then be used to top up your SimplyGo EZ-Link, EZ-Link card, or SimplyGo Concession cards.

1. Safeguard your EZ-Link Wallet with either one of the following:

- Activate the ‘Safety Switch’ via SimplyGo app immediately, if the user has his/her phone, OR

- Give consent to SimplyGo to suspend their wallet within 3 working days if the user reports their phone as lost and not retrievable.

2. Customer is to contact CIMB on the fraudulent top-up amount and dispute.

Please settle all outstanding balances with CIMB first.

Afterwards, you can remove CIMB PayEasy as a payment method by:

- Tapping “Profile” > Settings > Manage Payment Methods

- Next, select “CIMB PayEasy” under Others

- Then, tap “Remove”, followed by the “I understand and agree” checkbox

- Contact CIMB to terminate CIMB PayEasy

Note: You will not be able to remove CIMB PayEasy if you have an outstanding balance payable to CIMB.

You will need to reapply for CIMB PayEasy by clicking the CIMB PayEasy product banner on the EZ-Link Wallet Page.

No, your CIMB PayEasy account will not be automatically deactivated. You will need to contact CIMB directly to terminate the CIMB PayEasy account.

Please note that once your EZ-Link Wallet is deactivated, you will no longer be able to access your existing CIMB PayEasy account.

No, you will have to reapply for a new CIMB PayEasy account after reactivating your EZ-Link Wallet.

Please note the following:

- The EZ-Link Wallet can only be reactivated 30 days after it has been deactivated. You will need to contact CIMB directly to terminate your existing CIMB PayEasy account before reapplying for a new one.

Download the CIMB Clicks SG app to make repayments and manage your account.

For any query on repayment and related matters, please contact CIMB.

Request a temporary suspension of CIMB PayEasy via the CIMB Clicks SG app or contact CIMB.

There are no annual fees, interests, or processing fees.

However, a late fee of $20 per month is applicable for overdue payments.

If your outstanding amount exceeds $500 credit limit, an overlimit fee of $50 or 5% of the exceeded amount (whichever is higher) will apply.

For more information about CIMB PayEasy, please visit the CIMB website.

If you retained the same mobile number/SimplyGo login credentials, you could still log in to your SimplyGo account and access EZ-Link Wallet and CIMB PayEasy via the SimplyGo app downloaded on another mobile phone.

To update your mobile number, please call the SimplyGo Hotline at 1800-2255 663 (available from 8 am to 6 pm daily).

No, EZ-Link Reward points are not awarded when you top up the EZ-Link Wallet with CIMB PayEasy.

Earn EZ-Link Reward points by making payments with the EZ-Link Wallet.

Click here to learn more about EZ-Link Rewards.

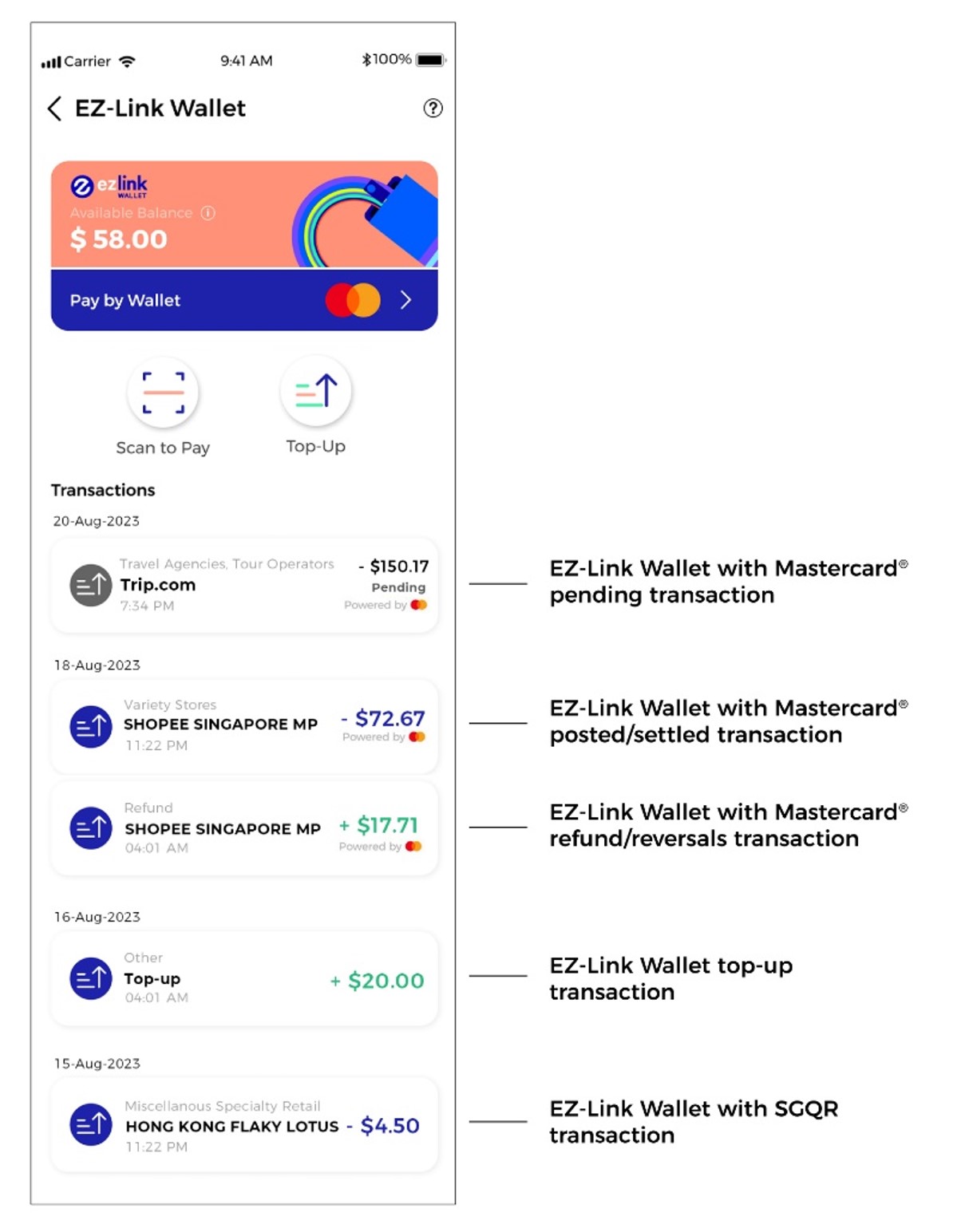

Your EZ-Link Wallet transaction history can be found on the EZ-Link Wallet details page. Transactions made with Mastercard are marked with the Mastercard logo for easy identification and tracking.

To identify the different types of transactions made on your EZ-Link Wallet, please refer to the image below:

Yes, users can add their EZ-Link Wallet with Mastercard to Google Pay (NFC enabled Android devices only) to enable payments for public transport.

No, this function is currently not available.

No, you are not able to do so.

Yes, purchases made both locally and overseas, except for exclusions for certain payments with the EZ-Link Wallet are eligible for EZ-Link Reward points. Every 10 cents spent using the EZ-Link Wallet earns you one EZ-Link Reward point, which can be redeemed for benefits from over 200 merchants across F&B, retail, motoring categories and more. Learn more about EZ-Link Rewards here.

Please note that cancelled or refunded transactions are not eligible for EZ-Link Rewards points.

Please check and ensure that you have sufficient balance in your EZ-Link Wallet and a stable internet connection to complete your purchase.

If your EZ-Link Wallet is less than the transaction amount, the transaction will be declined.

As part of our security measures, your EZ-Link Wallet with Mastercard will be ‘soft-blocked’ (temporarily disabled) for 24 hours following three unsuccessful OTP authentication attempts. Please perform your transaction again after 24 hours.

Should your card still be blocked after 24 hours, please submit your enquiry through the eFeedback form or contact the SimplyGo Hotline at 1800-2255 663 (8am – 6pm daily, except Public Holidays).

You can request for a full or partial refund if there is an issue with your transaction such as:

- not receiving the product(s)/service(s) that you paid for

- your goods were missing or damaged

- you have been charged incorrectly

In-store Purchases

Please inform the merchant immediately. The merchant will have to cancel the transaction so that your money will be transferred back into your EZ-Link Wallet.

Please note that this is only applicable to same day transactions. Any transactions performed after 23:59 hours cannot be cancelled. You will have to resolve the matter directly with the merchant.

Online Purchases

To request a refund, please contact the merchant directly. You may obtain the transaction details by clicking the transaction in question and sending this to the merchant for verification.

In some scenarios, your refunded amount may differ from the original amount charged. This could be due to:

- Partial refunds – The merchant has only refunded you partially and not in full.

- Cross-border/foreign currency transactions – The refunded amount depends on the currency rates on the day your refund was processed by the merchant

- Cross-border processing fees – Processing fees are charged for cross-border transactions and are non-refundable. These fees will only be refunded fully if the transaction is deemed fraudulent and have successfully been filed as a chargeback.

Please submit an eFeedback form to inform us about the unfamiliar transactions. Please note that you will only be able to file for chargeback within 90 days of the transaction. Monies will be credited back into your EZ-Link Wallet once the claims are successfully processed.

Immediately lock your Mastercard on the EZ-Link Wallet on the app to prevent any other transactions from being processed.

Please call SimplyGo Hotline at 1800-2255 663 if you wish to permanently block the account (Operational hours are from Mon-Sun, 8am to 6pm, excluding public holidays).

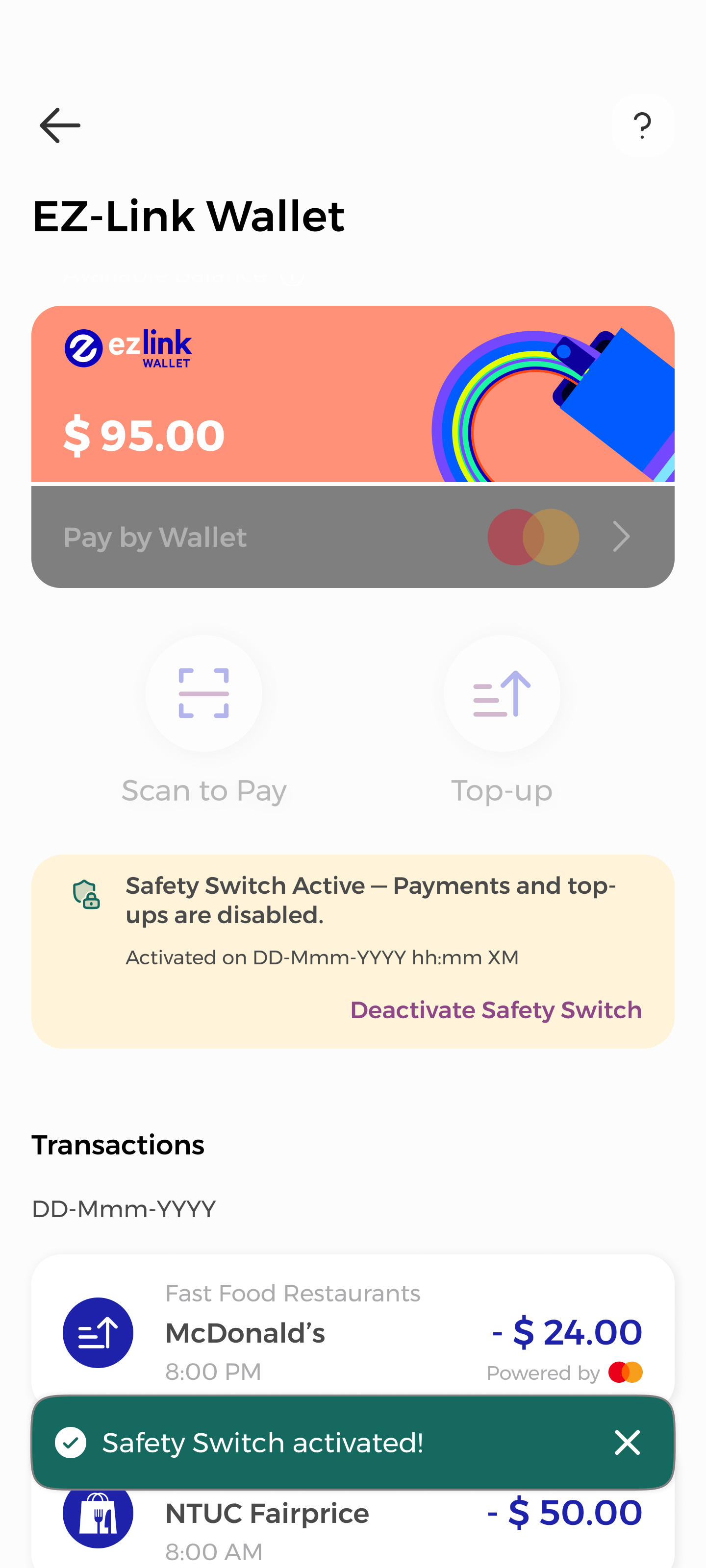

The Safety Switch is an anti-fraud feature designed to protect the funds in your EZ-Link Wallet. When activated, it prevents misuse of funds by disabling the following features for the EZ-Link Wallet:

- Wallet Top-up

- EZ-Link card, SimplyGo EZ-Link card and SimplyGo Concession card top-up using EZ-Link Wallet

- Scan SGQR usage

- Viewing of EZ-Link Wallet with Mastercard details

- Tap to Pay for transit rides and in-store

- Card-on-file payments

- Recurring payments

- Online payments

- E-voucher redemption for EZ-Link Wallet top-up

Other features on the SimplyGo app remain available for use.

By activating the Safety Switch, you add a layer of protection against scammers and fraudsters in the unlikely event that they gain unauthorised access to the funds in your EZ-Link Wallet. Your locked funds in the EZ-Link Wallet will remain safe with the Safety Switch activated.

Once activated, a yellow banner detailing the time of activation will be displayed on the EZ-Link Wallet Details page. All EZ-Wallet functionalities will not be available. You can only view your wallet balance and past transactions.

Yes, you can continue using your travel cards for transit or retail transactions. The Safety Switch only affects your EZ-Link Wallet usage.

No, the Safety Switch only disables the usage of EZ-Link Wallet. Your SimplyGo account and other SimplyGo app features, such as top-up of travel cards, EZ-Link Rewards redemption, and filing of claims will not be affected.

Yes, you can still view your EZ-Link wallet balance and transaction history while the Safety Switch is active.

No, all refunds, including pending ones, will still be processed.

No, the Safety Switch can remain active indefinitely until you choose to deactivate it.

An email notification will be sent to you upon successful deactivation of the Safety Switch. All EZ-Wallet functionalities will be restored.

The EZ-Link Wallet features do not expire. However, the Mastercard on the EZ-Link Wallet has a validity of three years. Your Mastercard will expire on the last day of the expiry month, as indicated on the virtual card.

Upon expiry, your EZ-Link Wallet with Mastercard will be automatically renewed with a new expiry date. All balances in your EZ-Link Wallet will remain valid as the EZ-Link Wallet does not expire.

If you wish to terminate your Mastercard on the EZ-Link Wallet, please submit an eFeedback form for further assistance.

Any balance amount in your EZ-Link Wallet will remain valid and may be used for other spendings.

If you wish to deactivate your EZ-Link Wallet, please submit an eFeedback form for further assistance. The balance amount in your EZ-Link Wallet will be refunded to your registered bank card.

Kindly note: To reactivate the EZ-Link Wallet with Mastercard, a waiting period of 30 days is required before reactivation can take place.